In the ever-evolving landscape of United States trade policy, a proposed shift in the tariff classification of “Whiskies” will allow for substantial excise tax savings by expanding the spirits industry’s ability to utilize a tax mitigation provision found in 19 USC 1313(j)(2) – better known as Unused Merchandise Substitution Drawback. This policy shift, if approved by Congress and signed into law, unlocks millions in additional tax savings benefits for U.S. whiskey producers and importers.

Duty Drawback: A Catalyst for Growth

Duty drawback, an excise tax and tariff mitigation strategy utilized by many alcohol beverage companies, facilitates the recovery of excise tax paid at the time of importation on alcohol sold in the United States when matched (substituted) to similar alcohol that is subsequently exported. The new proposed whiskey classification essentially establishes a “whiskey for whiskey” substitution standard which will allow a global spirits company that imports whiskey into the U.S. to secure a refund of excise tax assuming it also exports qualifying whiskey.

19 USC 1313(j)(2): Unused Merchandise Substitution

The modern duty drawback regime, originally enacted in 1789 as an export incentive program, allows imported duty or excise tax paid merchandise to be matched to exports at either the 8-digit or 10-digit HTS under the legal provisions of 19 USC 1313(j)(2). Additionally, the origin of the exports does not matter – meaning a claimant can utilize domestically produced merchandise that is exported and match these transactions against imported merchandise. As example, any exported domestically produced rye whiskey could be matched with an imported Japanese whiskey, assuming the federal excise tax is paid to Customs and Border Protection at the time of importation instead of being deferred and paid to TTB.

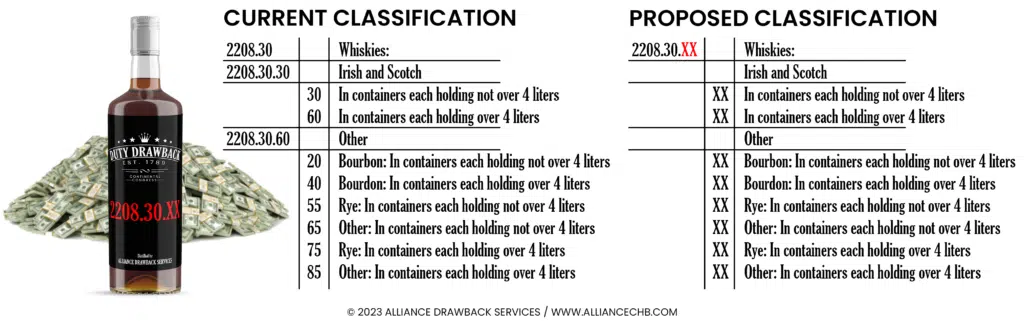

Whiskies Classification Barrier

Currently, when considering excise tax paid on imported whiskies, many (if not all) fall under the qualifying 8-digit classification 2208.30.30, “Irish and Scotch.” Looking at the export side of the equation, U.S. exported whiskies are classified as 2208.30.60, “Other”. This expands into “Bourbon”, “Rye”, or “Other” at the 10-digit suffixes. Consequently, current drawback opportunities for whiskies limits the matching opportunities to “Irish and Scotch” imports for exports of the same – not a common scenario as most imported “Irish and Scotch” whiskey is consumed in the U.S. and not re-exported.

Expanding Drawback Horizons

At the heart of this legislative proposal lies a golden opportunity for the spirits industry: an expansion of duty drawback benefits by aligning all whiskey classification to a single 8-digit classification. Producers stand to gain significantly by making all brown whiskeys interchangeable for drawback purposes.

Millions in Additional Recovery Opportunities

The crux of the matter lies in the downstream effect on drawback opportunities. With a more defined and specific classification, whiskey producers will unlock millions in additional recovery opportunities. Another example of the more flexible matching criteria – companies importing whiskey from Ireland will be able to match (substitute) against domestically produced Kentucky bourbon that is exported.

Industry Enthusiasm and Forward-Looking Perspectives

The spirits industry should view the proposed legislation with enthusiasm. Distillers and industry associations are actively engaging with policymakers to ensure that the new classification aligns seamlessly with the operational realities of the whiskey production process, maximizing the benefits for all stakeholders.

Conclusion: A Win-Win for the Spirits Industry

In conclusion, the proposed whiskey classification, coupled with the expansion of duty drawback benefits, marks a watershed moment for the spirits industry. The potential to unlock millions in additional recovery opportunities not only fortifies the financial resilience of producers, but also positions the industry for sustained growth and global competitiveness. As legislative discussions progress, the spirits industry eagerly anticipates the realization of this win-win scenario that promises to reshape the dynamics of the international spirits market by making US based whiskey suppliers more competitive, and by incentivizing global beverage companies to move manufacturing operations to the US to generate more drawback qualifying export sales.

For further guidance on navigating the evolving landscape of duty drawback, we encourage you to reach out to Alliance Drawback Services.

Maximize Your Drawback Refunds

No cost or obligation and easy to get started with Alliance. Identify new drawback program opportunity or evaluate the performance of your current program and maximize drawback refunds compliantly.