What Is Duty Drawback?

Duty Drawback is the refund of 99% of the duties, taxes and fees paid to Customs and Border Protection on merchandise imported into the United States that is either exported directly or matched with exported substituted product.

Compare Your Drawback Options

The Advantage of a Drawback Expert

General Brokers & Third Party Logistics Providers

General Customs Brokers that offer drawback services as an ancillary service usually do not possess the regulatory expertise, specialized software and analytics, and drawback specific knowledge to compliantly prepare drawback entries.

Since drawback is not their core service offering, they may lack operational resources to offer a turnkey solution, and instead will push critical elements of the process back on the drawback claimant.

Why Not Do It Ourselves?

The development and ongoing management of an in-house drawback program can be a daunting endeavor for your trade compliance department’s limited resources. Also, a lack of drawback knowledge and systems can result in missed recovery and compliance exposure. We offset our fees through recovery maximization.

A successful drawback program requires the following critical elements:

- Understanding drawback’s numerous legal provisions to select the most advantageous option when more than one can apply

- Extensive drawback specific regulatory expertise needed to avoid exposure with Customs

- Knowledge of operational process needed to accurately construct drawback claims

- Personnel resources to gather required documents and data elements

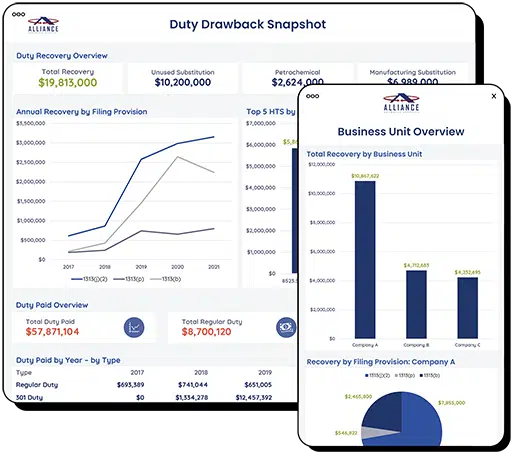

Additionally, highly sophisticated drawback software with extensive functionality is required to generate drawback claims for electronic submission in Customs’ ACE drawback processing module.

Subject Matter Experts

We focus on providing highly specialized drawback program management services and nothing else… no import brokerage, logistics, or trade compliance related services. We bring unparalleled statutory and regulatory expertise combined with cutting edge data analytics to each client’s program resulting in recovery maximization with the least amount of possible compliance exposure.

Alliance Drawback Services offers a comprehensive drawback solution – we take full responsibility for all elements of the drawback process from compliance to claim preparation. We operate strictly on a percentage of the recovery which incentivizes us to maximize the client’s recovery. Further, we assume as much of the administrative burden as possible so our client’s personnel can stay focused on its core business activities.

Get Your Complimentary Drawback Assessment

No cost or obligation and easy to get started. Evaluate the performance of your current program and maximize drawback refunds compliantly.