Is recoverable duty being left on the table? Drawback matching methods can drastically change the recovery landscape of a company’s duty drawback program.

It’s a common misconception that in order for a duty paid import to be drawback eligible, the very same imported product must be exported. While that is true to an extent, there is a lesser known method that can be used to claim drawback where the original import is never exported.

First, we need to establish the fundamentals of Direct Identification matching method in a drawback program.

Direct Identification matching uses lot or serial number tracing to match an exported product with its exact importation. In the absence of lot or serial number tracing, an acceptable inventory accounting method can be utilized to comply with CBP requirements. For example, your company imports duty paid sunglasses into the United States, packages them and then exports them to Canada. Let’s assume that the sunglasses enter inventory using lot numbers. These lot numbers can trace the sunglasses entering your inventory and then leaving inventory when they are exported to Canada.

So how does an export that was never imported get used in a drawback claim?

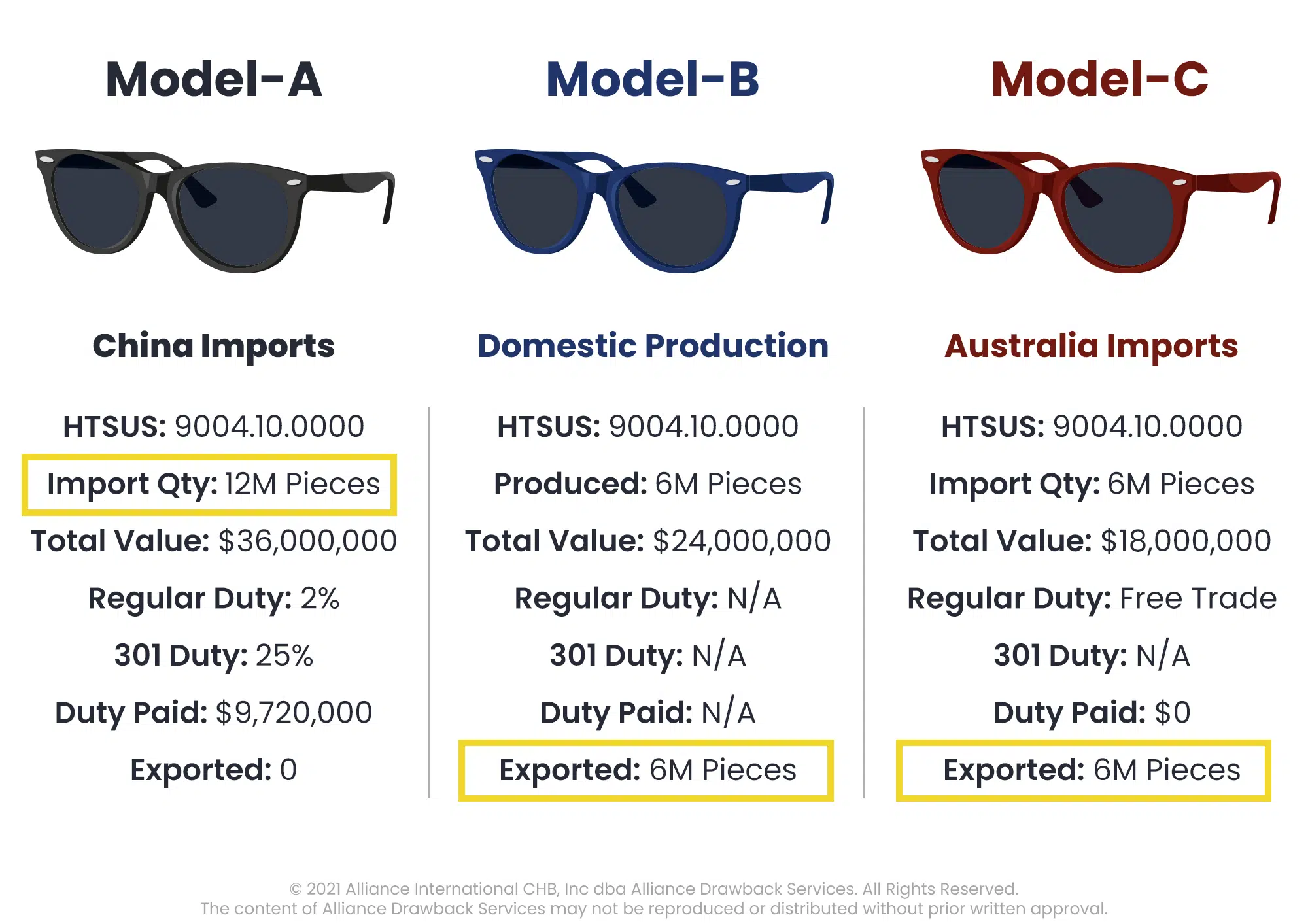

Let’s say your company imports duty paid sunglasses into the United States from China. The regular duty rate of sunglasses (HTS 9004.10.0000) is 2% Ad Valorem. We need to also apply an additional 25% China Tariff rate (Section 301) because the import originated in China. These imported sunglasses (let’s call them Model-A) are sold in the United States. End of drawback eligibility? Nope!

Here is how imports can become drawback eligible using the substitution matching method.

Your company also domestically produces Model-B sunglasses and imports Model-C sunglasses from Australia (duty free FTA origin) that are both exported from the United States. Since Model A, B and C all fall under the same HTS 9004.10.0000 for sunglasses, the HTS number can be used to match similar product or “substitute.”

In the example above we can substitute 6 million pieces Model-B and 6 million pieces Model-C exported sunglasses to claim drawback on the 12 million pieces Model-A sunglasses that were imported duty paid from China, using HTS 9004.10.0000. This example assumes that all of the Model-B and Model-C exports took place after the Model-A imports.

However, substitution matching comes with two caveats.

- The HTS number can not be classified as “Other” at the 8th digit as well as the 10th digit. The is commonly referred to as “Other Other” in the industry.

- The export destination can not be to a USMCA (formerly NAFTA) country or US territory. This includes US exports to Canada, Mexico and Chile.

If the export falls within either of these two scenarios then the Direct ID matching method must be used. This does not apply to the manufacturing provision of duty drawback.

Going back to our Model-A, B and C sunglasses example – let’s assume all of the Model-B sunglasses are exported to Mexico and all of the Model-C sunglasses are exported to Brazil. Only the Model-C exports would qualify to use the substitution matching method because Model-B is exported to Mexico (USMCA) and do not trace back in inventory, cutting your recoverable duty in half.

It’s very important to conduct a regular, thorough analysis of your company’s import and export activity for drawback eligibility.

Drawback programs should be continuously assessed. Regulatory changes, company acquisitions and new products or logistics pipelines can all impact not only your drawback recovery, but regulatory compliance as well. Contact Alliance, the duty drawback experts for a complimentary assessment today!

Maximize Your Duty Drawback Refunds Compliantly

No cost or obligation and easy to get started with Alliance. Identify new drawback program opportunity or evaluate the performance of your current program and maximize drawback refunds compliantly.