Duty Drawback News & Alliance Events

Read the latest duty drawback news and stay up to date with Alliance events and conferences.

Duty Drawback News & Events

Drawback information, regulation changes and our events

Reciprocal Tariffs are Drawback Eligible

In a significant development for U.S. importers and exporters, the newly announced reciprocal tariffs from the Trump administration have been confirmed as duty drawback eligible. This presents a major opportunity for companies to recover tariffs paid on imported goods when those goods, or similar articles, are subsequently exported or destroyed. What Are Reciprocal Tariffs? Reciprocal tariffs are part of the administration’s push to level the playing field in global trade.…

Pouring Profits: The Spirits Industry’s Golden Opportunity with New Whiskey Classification

In the ever-evolving landscape of United States trade policy, a proposed shift in the tariff classification of “Whiskies” will allow for substantial excise tax savings by expanding the spirits industry’s ability to utilize a tax mitigation provision found in 19 USC 1313(j)(2) – better known as Unused Merchandise Substitution Drawback. This policy shift, if approved by Congress and signed into law, unlocks millions in additional…

2022 ICPA Summer Conference

Attending the upcoming 2022 ICPA Summer Conference in Atlantis June 5-8? Alliance Drawback Services founder & CEO, Anthony Nogueras, will be presenting two sessions on duty drawback subjects you won’t want to miss. Monday, June 6th, 4:15pm EST – “Drawback 201: Taking Your Drawback Program to the Next Level”Wednesday, June 8th, 11:15am EST – “How to Maximize Your Drawback Program While Minimizing Compliance Risk” The…

How Section 301 Exclusions Affect Drawback

On March 23, 2022, the USTR (United States Trade Representative) Office announced the reinstatement of Section 301 exclusions for certain categories of products previously subject to the punitive tariffs for goods originating in China. The reinstated Section 301 exclusions (see list below) cover certain types of machinery, motors, electrical equipment, chemicals, plastics, textiles, bicycles, motorcycles, and automotive parts, among other items. The exclusions will apply…

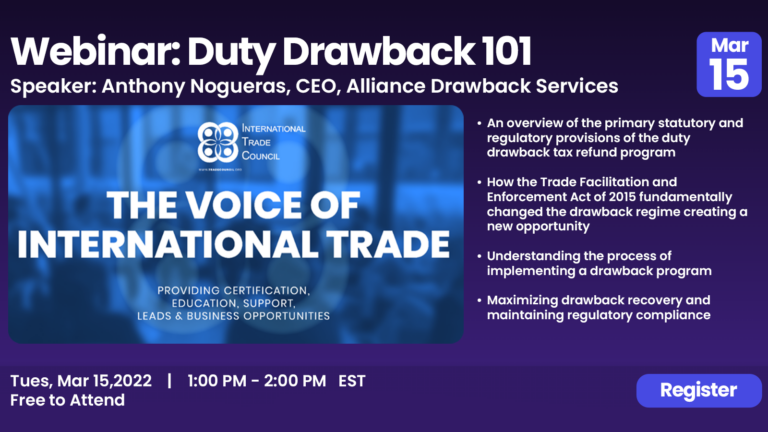

ITC Webinar: Duty Drawback 101

Alliance Drawback Services founder and CEO, Anthony Nogueras, will be presenting a “Duty Drawback 101” webinar with Q&A for the International Trade Council. Duty drawback allows US-based importers to receive refunds on imported duty paid merchandise that is subsequently exported or destroyed This webinar will cover the following topics: An overview of the primary statutory and regulatory provisions of the duty drawback tax refund programHow…

2022 ICPA Annual Conference

Come join Alliance, a Global ICPA Partner, February 27th – March 2nd, 2022, in San Diego, CA at the ICPA Annual Conference. The ICPA is an amazing organization and provides networking opportunities as well as educational and professional resources to the global trade compliance community. Speaking sessions, networking and “virtual booths” are available to attendees that cannot make it, but still want to join online.…

Alliance Secures Minority Owned Business

Alliance Drawback Services has officially secured its status as a minority owned business as certified by the Florida State Minority Supplier Development Council (FSMSDC). Mr. Nogueras commenting on the minority owned designation stated that, “My father came to this country in 1962 as a political refugee from Cuba with only the shirt on his back. Seeking a better life and to participate in the American…

2021 ICPA Summer Conference

Come join Alliance, a Global ICPA Partner, July 25-28 in Orlando, FL at the ICPA Summer Conference. The ICPA is an amazing organization and provides networking opportunities as well as educational and professional resources to the global trade compliance community. Speaking sessions, networking and “virtual booths” are available to attendees that cannot make it, but still want to join online. Tuesday, July 27th from 1:15PM-2:15PM…

Section 301 Tariff Refunds

Section 301 Tariff Duties have greatly impacted U.S. Companies since their inception by the Trump Administration in mid 2018, affecting an estimated $500 billion in imported goods from China into the United States. This exponential increase in duties has left many companies scrambling for solutions to mitigate these China tariff duties. Reevaluating classifications and product designs or finding alternate sourcing could be a possible solution,…

Drawback Import & Export Matching

Is recoverable duty being left on the table? Drawback matching methods can drastically change the recovery landscape of a company’s duty drawback program. It’s a common misconception that in order for a duty paid import to be drawback eligible, the very same imported product must be exported. While that is true to an extent, there is a lesser known method that can be used to…

OW Logistics Insight Interview

Alliance Drawback Services was featured on Ocean Wide Logistics where Anthony Nogueras and Nicole Kartchner give insight into the duty drawback industry. Watch the interview Maximize Your Duty Drawback Refunds Compliantly No cost or obligation and easy to get started with Alliance. Identify new drawback program opportunity or evaluate the performance of your current program and maximize drawback refunds compliantly.

2021 ICPA Spring Conference

Mark your calendars! Alliance Drawback Services will be attending and presenting at the ICPA (International Compliance Professionals Association) Spring Conference in San Antonio, TX, March 28-31, 2021. This conference provides a wealth of educational information to the trade community – presented by industry leaders. If you are involved in Import/Export Compliance or Operations, Supply Chain Compliance or Security, Internal Controls or Government Relations then this…

TFTEA Changes

The Trade Facilitation and Enforcement Act of 2016 (known by its acronym TFTEA) dramatically changed the playing field for drawback claimants. The more significant changes include: A substantial liberalization of the rules for matching imports and exports for drawback purposes under the Substitution Drawback provision. Specifically, the new rules eliminated the need to match at the part number level and allows for broader matching at…

Titanium Industry Drawback

Section 301 Tariffs assessed on imported titanium products from China are eligible for refund via this program. Extensive changes to any legal, and by extension, regulatory structure result in a distinct set of “winners” and “losers” – in other words, certain industries or drawback claimants benefited more from the TFTEA changes than others. Without a doubt, the titanium industry falls into the TFTEA “winner” category.…

TFTEA Transition

Members of the AAEI and NCBFAA, Drawback Committees, Alliance included, met with CBP Drawback Officials in Virginia in late August to review outstanding issues with TFTEA drawback and ACE drawback filings. The CBP contingent consisted of national-level Customs officials from the Office of Trade Commercial Operations as well as attorneys from Regulations and Rulings. Addressing the status of the modification of manufacturing drawback rulings required…

Multiple Party Drawback

The drawback regulations (found in 19 CFR 190) allow for the transfer of drawback rights when the importer and exporter of record are not the same entity. While either entity can submit the drawback claim to Customs (referred to as the drawback claimant), the drawback regulations grant the exporter the first right to submit the drawback claim to Customs and Border Protection (CBP). However, if…

Section 301 Tariff Eligibility

Under Section 301 of the Trade Act of 1974, the US Trade Representative’s Office, under the direction of the Trump Administration, initiated an investigation to determine whether China’s acts, policies, and practices related to technology transfer, intellectual property, and innovation are unreasonable, unjustifiable, or discriminatory and burden or restrict U.S. commerce. The resulting Section 301 action places a 25% punitive duty on approximately $50 billion…

Drawback Community Court Case

The Trade Facilitation and Simplification Act of 2016 (known by its acronym TFTEA) significantly liberalized, and sought to simplify the export incentive program referred to as duty drawback. The statute mandated a two-year implementation period to allow Customs sufficient time for rulemaking and the programming changes (drawback filing was stilled mired in Customs’ legacy system ACS) needed to fully automate the submission of drawback claims.…

The “Other Other” Problem

The primary liberalization of the duty drawback law passed as part of the Trade Facilitation and Enforcement Act of 2015 (TFTEA) involved redefining the substitution provision of the drawback law. While this “game-changer” will increase drawback recovery dramatically, the devil, as the saying goes, is in the details. Some background The substitution method allows a drawback claimant to match “commercially interchangeable” or like merchandise within…

My Customs Broker Handles That

It’s common for importers to rely heavily on the services of their Customs brokers. Customs brokers are knowledgeable professionals licensed by U.S. Customs and Border Protection (“CBP”). They are “plugged in” to CBP’s computer systems, and get real-time updates on changes to regulations and practices. Brokers do a complicated job with precision and speed. But there’s a limit to how much importers should rely on…

Wine Drawback Parameters

Customs Headquarters in a long-awaited ruling issued its interpretation related to a provision of the Food, Conservation, and Energy Act of 2008 that addressed the commercial interchangeability of wine for drawback purposes. Section 15421 of the law states—for drawback purposes imported and exported wine will be matched on a color for color basis (e.g. red for red and white for white) within a 50 percent…

TFTEA Drawback Update

This week we enter the transition period from historical drawback regime to the new era promulgated by the TFTEA (Trade Facilitation and Enforcement Act of 2015 also referred to as the New Drawback Law) which officially becomes operational Saturday, 2/24/18. Alliance staff will begin submitting claims via the new drawback module in ACE on this date. We are hoping for the best, but the more…

Customs ACE Transition Delayed

A 12-year collaborative effort between Customs and Border Protection and the Trade Community resulted in a new drawback statute found in 903 of HR 644 enacted as “The Trade Facilitation and Trade Enforcement Act of 2016.” The legislation set in motion an extensive and fundamental transformation of the 200-plus-year-old duty minimization strategy known as duty drawback refunds. Simply stated, the drawback program allows for the…

Get Your Complimentary Drawback Assessment

No cost or obligation and easy to get started. Evaluate the performance of your current program and maximize drawback refunds compliantly. Identify new drawback program opportunity.